PAYROLL QUERIES

If you have any queries or doubts regarding the payment structure, you can always speak to one of our staff members. We will be happy to guide you.

PAYMENTS CAN BE MADE THROUGH AN APPROVED UMBRELLA COMPANY OR PAYE

We only use umbrella companies that are FCSA accredited and they show that the appropriate tax and national insurance deductions are made from all payments. We recommend you contact several before making your choice, as each one may have slightly different charge rates as well as additional services & offers that, depending on your circumstances, may be attractive to you.

The main benefit of using an umbrella is that you will receive payments from the same company and they will know all your income details and be able to utilise your full personal tax allowance and pass all tax and NI deductions onto HMRC.

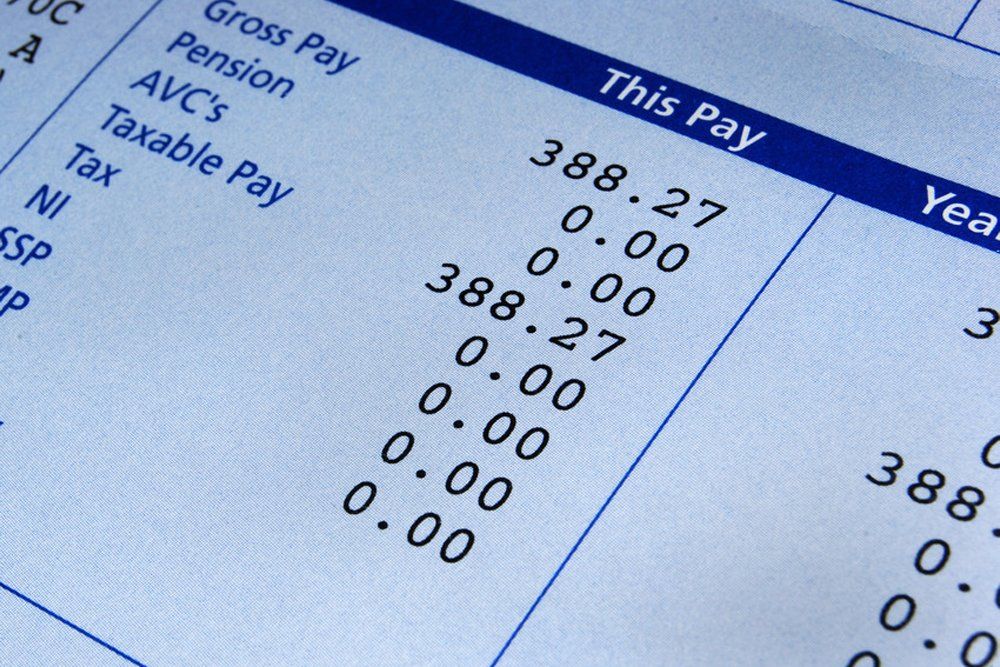

If you would prefer to be paid PAYE, we will deduct income tax and national insurance (NI) from your gross pay. Your payment will be accompanied by a payslip that states the dates for which you have been paid, the split between basic and holiday pay, the amounts deducted for tax, national insurance and your net pay.

REGISTER YOUR INTEREST

- What could cause delay in receiving payment? -

Failure to complete your timesheet correctly and sending in clear readable copies can delay payment.

Please make sure that the following is completed on each timesheet:

- Enter your full name

- Ensure the correct dates are entered

- Complete the details of hospital/trust and ward where you worked.

- Make sure an authorised representative of the Hospital/Trust signs your timesheet

- Have you completed the details of each shift accurately and included the booking reference number if known?

- Ensure the break deductions are entered

- Calculate the hours correctly

Please then fax your timesheet to us. This is the simplest and most reliable method. Scanned copies is also accepted.

ALL TIMESHEETS MUST BE CLEAR AND READABLE, PLEASE CHECK BEFORE SENDING

CLIENT SYSTEMS & PROCESSES

Some positions involve using clients' third party software to manage their agency shifts. These often require input from members of staff at the hospital or location where you worked. Sometimes the input of hours can be delayed.

The input of your hours are out of our control and we will only be able to pay you when the clients system has been updated to show us that we can. We make every effort to ensure that this does not cause undue delay but we cannot guarantee that it will not affect the speed at which we are able to process your payment.

These systems and online portals include the following:

- NHSP

- 247 Time

- GRI (eTips)

- LMS

- HCL Clarity

- Day Webster - Merlin

- Brookson Portal

- NHS Health Roster

- Tempre

- Stafflow

- Medacs/Envoy

- HB Retinue